For years, petroleum companies have used GIS as a tool to decide where to drill a well, route a pipeline, build a refinery. The Oil and Gas industry is driven by an estimated 80% data that has a spatial component.

This is the only industry that harnesses spatial information at every stage of the life-cycle, beginning with opportunity analysis and exploration, through appraisal and production, right up to the abandonment phase.

The growth and development of countries worldwide has led to a steep rise in the demands for oil and gas. This has led to the oil and gas mining industries to invest more in progressive and adaptive technologies like GIS for oil and gas. Crude oil and gas is now found in further deep across the earth’s surface than it was previously, and hence it is essential to use precise technologies like GIS for oil and gas for fuel exploration and appropriate utilization.

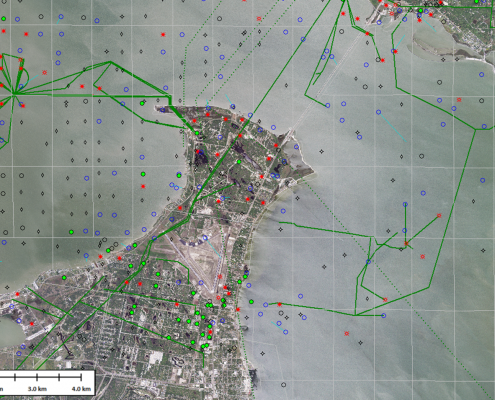

Basin Analysis – map of potential hydrocarbon accumulations; hydrological modeling; sub-surface secondary fluid migration network mapping; flow direction – flow accumulation mapping across DEM; potential migration pathways, etc.

Play Analysis – risk segment mapping for each petroleum play element; regional risk mapping; geological maps; ground truthing or validating imagery through field surveys

Acreage Analysis – rapid evaluation and gradation of opportunities using multi-disciplinary asset data and assigning weightings and criteria; ranking of acreage, petroleum leases, blocks and companies; exploration statistics in visual platform, etc.

Prospect Analysis – hydrocarbon reserve or volume estimation; raster analysis based deterministic prospect volume of petroleum reservoirs; reserve estimation and spatial analysis of well data in unconventional hydrocarbon, like shale, and so on.